Laboratory Instrumentation

Anton Paar has a long history of providing high-end laboratory instruments: density meters, refractometers, polarimeters, instruments for sample preparation and synthesis, viscometers, rheometers, and instruments for material characterization.

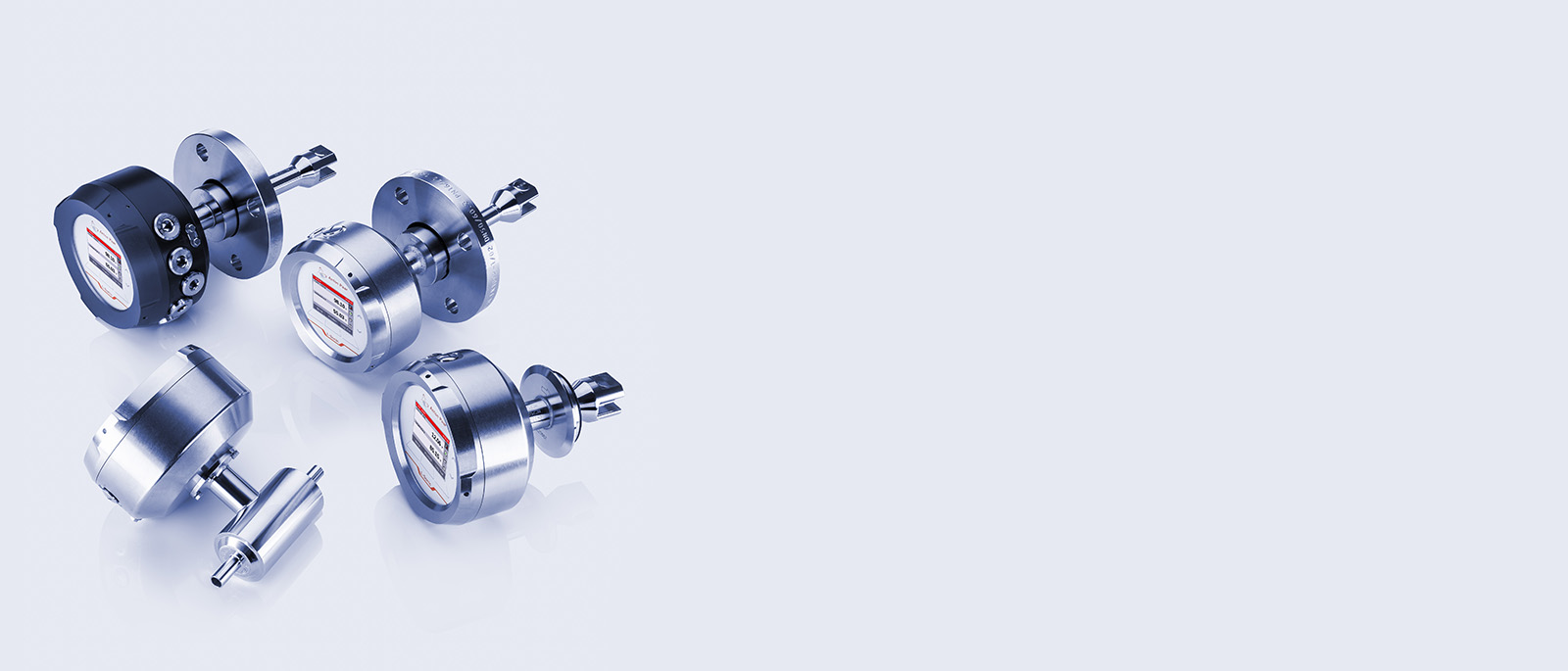

Process Instrumentation

Anton Paar has your solution for inline production monitoring: The portfolio covers density and concentration sensors, inline refractometers, process viscometers and sensors for measuring dissolved CO₂.

Automation & Robotics

Anton Paar designs custom-tailored automation solutions from the first idea to final production: sample changers for automating single devices, robotically operated rheometers and a platform which automates multiple instruments.

News from the Anton Paar Group

About Anton Paar

Anton Paar develops, produces and distributes highly accurate laboratory instruments and process measuring systems, and provides custom-tailored automation and robotic solutions. It is the world leader in the measurement of density, concentration and CO2 and in the field of rheometry. Anton Paar GmbH is owned by the charitable Santner Foundation.

Over 4400 employees at the headquarters in Graz and the 37 sales subsidiaries worldwide ensure that Anton Paar products live up to their excellent reputation. The core competence of Anton Paar – high-precision production – and close contact to the scientific community form the basis for the quality of Anton Paar’s instruments. Read more

Anton Paar GmbH – Headquarter

Anton-Paar-Straße 20

8054 GRAZ

AUSTRIA

Tel.

+43 316 257 0

Fax

+43 316 257 257

info[at]anton-paar.com

Opening hours

Monday to Friday: 07:00AM - 05:00PM